VAT is implemented in the UAE with effect from 1st January 2018. VAT (Value Added Tax) is an indirect tax which is charged at every level of supply of goods or services or both. Businesses need to take necessary steps for VAT implementation in UAE into their operations. We support to businesses for VAT implementation in Dubai, Abu Dhabi as well as Sharjah and all other northern emirates. Steps involved in VAT Implementation Services We believe that the businesses should be guided properly for VAT implementation in UAE to comply with UAE VAT law and develop a sustainable tax strategy. The procedure for effective VAT implementation is as follows:

Understand the business models

The TAX experts/ VAT Experts visit your office to understand the business model for designing a VAT Implementation plan which suits for the UAE VAT Regulations for your business.Training to the Management & Employees

In this phase, we provide training on the concepts of VAT in the UAE & discuss about the business type & its issues on compliance to the UAE VAT Law. Provisions shall be made to train the employees from each department having implication on VAT.Analyzing the impact of VAT on your business

In order to have a better clarity and appraisal for the management and to streamline the operations of the company by complying with the UAE VAT requirements, we study the impact on business on working capital, costing and profitability.Identifying a VAT team leader | VAT Implementation Project manager

For shifting the transactions into UAE VAT compliance and to function smoothly and in a timely manner, we will select a responsible person/team from the company to be the head of the VAT Implementation project called VAT Implementation Project Manager.Registration for VAT

As part of VAT implementation, to comply with the law of the land with respect to VAT (UAE VAT Law), we advise regarding the procedural formalities and the date by which registration has to be made, considering whether the company got any exemption in this respect or not, whether the group registration or standalone is more apt etc.Accounting systems under VAT

The present accounting systems will be scrutinized. Proper classification/ grouping with appropriate chart of accounts suitable for VAT regime will be suggested. Necessary guidelines will be given to the accounts team for preparing the first VAT return to the Federal Tax Authority (FTA).Invoicing under VAT

The requirements of VAT invoicing (and issuance of credit note) under the UAE VAT Law will be implemented. Proper guidance will be given to the IT persons and proper training to the Accounts and other departments connected to sales will be given.IT Migration

In order to incorporate the changes in the billing, accounting and other administrative procedures to comply UAE VAT formalities, necessary guidance or information required will be communicated to the IT team/software personnel either directly or through VAT Implementation Project Manager. VAT Returns Filing has to be done through online portal of the Federal Tax Authority (FTA) available under e-services. The form used for VAT return filing is called Form VAT 201. A taxable person is responsible to submit VAT return in the UAE in the prescribed format given by the FTA. Every taxable person is required to submit the VAT Return within 28 days from the end of each Tax period prescribed by the FTA. This must be in accordance with the provisions of the UAE VAT law. The taxable person is also liable to remit the amount of tax due to the FTA within the time frame specified by the UAE VAT Law; ie within 28 days from the end of each tax period.How do we help you for filing your VAT Return – Form VAT201?

Our Tax professionals can support you in the following areas

We will visit your office on a periodical basis (weekly/monthly/Quarterly) to compile the information for filing the VAT Return. At the end of each VAT return period, we prepare the VAT return of behalf of your company in accordance with the provisions of UAE VAT law. We ensure that the VAT returns are filed within the specified time in each tax period. Proper guidance for the payment of Minimal Tax Liability as per the provisions of the UAE VAT Law will be advised. Optimal Tax Planning for the company will be done. We will be available to represent in front of the authority on behalf of you as and when required.

How the VAT returns – Form VAT201 – are filed?

VAT Returns are to be filed through online portal of the FTA. One has to access the VAT Return Form by login into the e-services of the FTA portal by using the respective user name and password. Our Tax Expert will help you fill the VAT return form with all relevant information within the due date prescribed by the authority.

What are the information to be provided in the VAT Return?

The VAT return discloses the Tax amount due (or refundable as the case may be) for a particular Tax Period. One has to disclose the total output tax payable as well as the input credit available against such Output separately. Excess of Output Tax over and above the Input Tax for a tax period is the amount of Tax Liability to be paid. The content of the VAT Return Form includes the following:Output Tax

Tax Liabilities under Standard Rated Supplies (5%) emirates wise.

Tax Liabilities on goods imported through customs.

Tax on goods imported on which tax liabilities are not created – if any.

Tax liability on import of services.

Tax refunds provided to tourists.

Input Tax

Tax on Standard Rated purchases

Tax on Standard rated expenses.

Tax on import of goods

Tax on import of services

Tax amount disclosed under Output Tax over and above the Input Tax is the amount to be paid to the FTA for a particular tax period within the due date.

Filing of Return VAT Return

The support for preparing and filing of the first VAT return by taking the correct input tax credit against the total VAT liability with guidance on planning/better timing of cash flows. Excise Tax Registration Service in the UAEWhen to register for Excise Tax in the UAE?

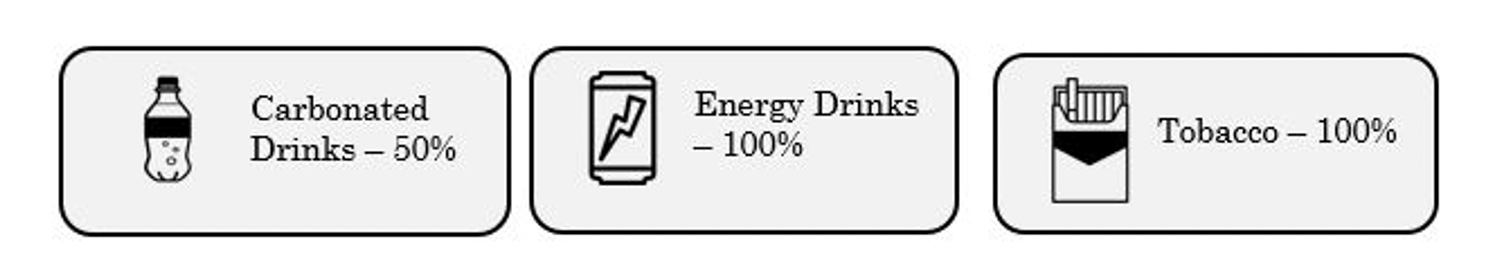

The Registration for Excise Tax in the UAE has started from 17th September 2017. All Taxable entities are entitled to register for Excise tax through the FTA’s online portal. The Excise Tax Federal Decree-Law No. (7) of 2017 in the UAE shall be effective from 1st October 2017. Hence the registration has to be done on or before 30th September 2017.Which are the goods subject to the Excise Tax in the UAE?

Who should register for Excise Tax in the UAE?

The below-mentioned groups will now have to register for Excise Tax in the UAE• Producers of Excise goods.

• Importers of Excise goods.

• Stockpilers of Excise goods.

• Warehouse keepers responsible for excise goods.

What are the information and documents to be given while registering for Excise Tax?

An applicant while registering for Excise Tax should provide following:

• Details of the applicant (name / legal type / other legal details)

• Contact Details

• Banking information

• Business Activity & related information

• Customs Registration details

• Declaration

Businesses are required to have the legal documents relating to the Entity.

• Trade License

• Certificate of Incorporation (if you have)

• Articles of Association

• Partnership Agreement

• Document of Ownership

• Emirates ID etc

• Customs Registration Document or Customs Number

• Power of Attorney if applicable